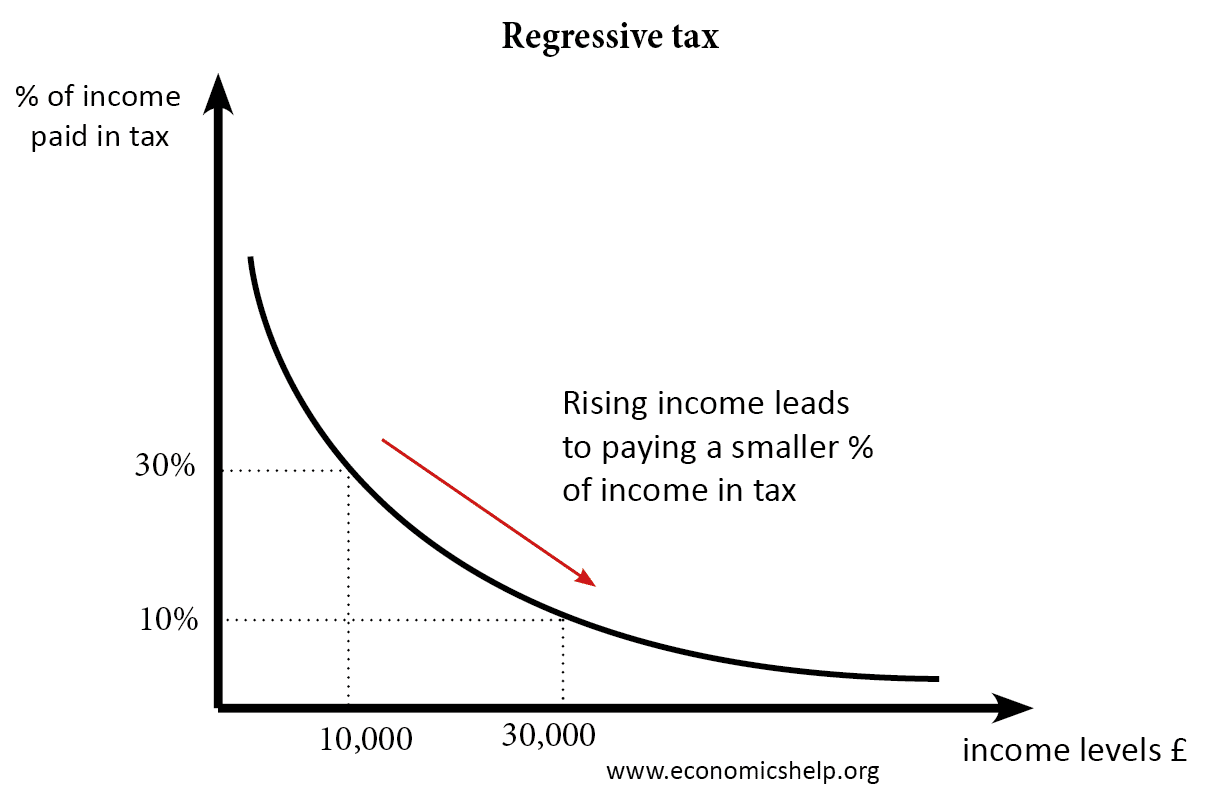

Regressive tax

A regressive tax is a tax which takes a higher percentage of tax revenue from those on low incomes. As income increases, the proportion of your income paid in tax falls. Suppose there is a poll tax of £3,000 (paid regardless of income) In this case, the person earning £10,000 is paying 30% of their …